-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

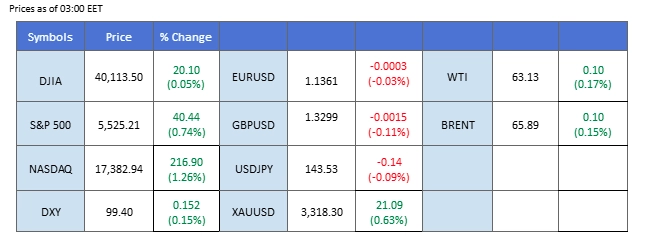

Market Summary

U.S. equities extended their rally overnight, with the Dow Jones reclaiming the 40,000 mark and the Nasdaq outperforming, supported by renewed optimism around global trade developments. President Trump’s comments that the U.S. is “very close” to a deal with Japan, alongside ongoing negotiations with China and potential interim agreements with Iran, lifted sentiment, particularly in the tech and industrial sectors. The advance helped erase prior session losses and reinforced positive market momentum.

Adding to the bullish tone, former Federal Reserve Governor Kevin Warsh’s criticism of the Fed’s transparency sparked speculation of a potential shift toward a more cautious policy approach. Inflation expectations edged higher, with traders increasingly betting that the Fed will delay rate cuts until clearer signs of disinflation emerge. Upcoming PCE and jobs data are expected to be critical for shaping policy expectations.

In currency markets, the U.S. dollar remained flat as investors awaited key catalysts later this week, including the PCE report and jobs data. Safe-haven demand persisted despite the risk rally, with gold prices holding near elevated levels on ongoing political and policy risks.

Moving forward, geopolitical tensions remained in focus, with President Trump’s efforts to negotiate a Ukraine-Russia peace deal keeping markets cautious, alongside continued concerns over global trade headwinds and warnings from the IMF about tariff-driven growth risks.

Current rate hike bets on 7th May Fed interest rate decision:

0 bps (95.2%) VS -25 bps (4.8%)

Source: CME Fedwatch Tool

Market Overview

Economic Calendar

(MT4 System Time)

N/A

Source: MQL5

Market Movements

The Dollar Index, which tracks the greenback against a basket of six major currencies, remained flat as investors awaited key catalysts later this week. On the trade war front, President Trump mentioned that tariff negotiations with China were underway, though Beijing denied active talks were taking place. Despite the mixed signals, both sides have expressed willingness to engage, which investors are closely monitoring for future dollar direction. Attention is also turning to the upcoming U.S. Nonfarm Payrolls and Unemployment Rate report on Friday, expected to be another critical driver for the dollar.

The Dollar Index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 31, suggesting the index might enter oversold territory.

Resistance level: 105.80, 110.00

Support level: 99.40, 96.15

Gold prices remained within a tight range, struggling for a clear direction amid conflicting developments. Uncertainty over US-China trade talks kept some safe-haven demand intact, while progress in ceasefire negotiations between Israel and Hamas slightly eased geopolitical tensions. UAE Foreign Minister Sheikh Mohammed noted some progress but highlighted that major disagreements remain. With mixed sentiment from both fronts, gold traders are advised to monitor upcoming headlines closely for trading signals.

Gold prices are trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 46, suggesting the commodity might extend its gains since the RSI rebounded from oversold territory.

Resistance level: 3375.00, 3495.00

Support level: 3275.00, 3200.00

The GBP/USD pair has remained trapped within its fair-value gap over the past few sessions, struggling to find enough momentum to break above this zone, suggesting a bearish bias for the pair. The market’s focus remains on the evolving U.S. tariff policy, with the Trump administration recently adopting a more conciliatory tone to soothe market concerns. This shift has helped the U.S. dollar regain strength, with the dollar index climbing toward the $100.00 mark, adding further pressure on the GBP/USD pair.

Price is now kept within its FVG. A break below from such a zone at the near 1.3280 mark should be a bearish signal for the pair. The RSI remains flowing close to the 50 level after dropping out from the overbought zone, while the MACD is on the brink of breaking below the zero line, suggesting that the bullish momentum has vanished.

Resistance level: 1.3340, 1.3420

Support level: 1.3270, 1.3185

The HK50 (Hang Seng Index) extended its gains, showing resilience despite ongoing US-China trade tensions. Investor confidence was bolstered after Chinese President Xi Jinping pledged to introduce new monetary tools and financial support to strengthen sectors like technology, consumption, and trade. Measures include targeted aid for companies hit by tariffs and an increase in job stabilization funds. Nonetheless, the trade war remains the key catalyst for future Hang Seng movements.

HK50 is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 49, suggesting the index might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 22640.00, 24670.00

Support level: 21015.00, 19155.00

The US equity market continued its rebound, with Nasdaq leading gains thanks to strong earnings from major firms like Tesla and Google. The rally could extend further as investors await upcoming results from Apple and Microsoft. Meanwhile, sentiment improved amid signs of a potential de-escalation in the Trump administration’s trade stance. However, the situation remains fluid, and any negative developments on tariffs could quickly reverse market optimism.

Nasdaq is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 62, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 19490.00, 20135.00

Support level: 18845.00, 18045.00

The USD/JPY remains in a broader downtrend as risk-off sentiment supports the yen. While optimism over a potential U.S.-Japan trade deal has strengthened the U.S. dollar against the yen, uncertainty from China’s denial of tariff negotiations has added volatility. Rising inflation in Japan, highlighted by Tokyo’s core CPI hitting a two-year high, supports expectations for potential Bank of Japan rate hikes in 2025. USD/JPY is likely to stay range-bound short term, with traders focused on upcoming catalysts like U.S. PCE inflation data and the Bank of Japan’s next policy decision.

USD/JPY is trading higher and approaching a key resistance area. However, MACD has shown signs of weakening bullish momentum, while RSI is hovering at elevated levels and starting to retreat after testing overbought conditions. This suggests that USD/JPY could face a technical correction if it fails to break decisively above the resistance.

Resistance level: 143.95, 147.15

Support level: 140.45, 137.45

Oil prices edged higher on Friday but still recorded a weekly decline, pressured by fears of oversupply and uncertainty over US-China tariff negotiations. Several OPEC+ members have suggested accelerating output increases for a second month, according to Reuters. Additionally, progress in ceasefire talks between Israel and Hamas raised expectations of higher oil supply, further capping crude gains.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 54, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 64.45, 66.65

Support level: 62.00, 59.65

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!